By TREVOR HOGG

By TREVOR HOGG

Juggernauts like DNEG and Framestore are not impervious to the volatility of the visual effects marketplace, as demonstrated by the dissolution of Technicolor, while mainstays like ILM, Scanline VFX, Pixomondo and Sony Pictures Imageworks have become the property of streamers and Hollywood studios. Despite the perpetual financial uncertainty, there is one constant fact that remains, which is that digital augmentation has become a fundamental part of filmmaking and the ambitions of each new generation of cinematic talent keep pushing the boundaries of technology to achieve their growing creative ambitions. So, how do the smaller visual effects companies find prosperity within this environment where budgets and schedules are getting tighter and more demanding? The answer is not singular but as multifaceted as crafting a believable photoreal CG image.

BUF has been around for 40 years with the main facility located in Paris and a second one established 10 years ago in Montreal; their specialty has remained the same, which is conceptualizing specific designs for film and television productions. “They always come to us saying, ‘We want something we’ve never seen before,’” states Olivier Cauwet, VFX Supervisor at BUF. “When we were working on American and Luc Besson movies, we had 300 employees; it was too much and changed the spirit of BUF. We wanted to have fewer artists, so now we’re around 140, which allows us to preserve our philosophy and the spirit of how we work. We’re not growing too much because with the [current] market, it’s dangerous to go too fast because you can lose everything.” Project demands have greatly increased. Cauwet says, “My first movie was as an artist on Fight Club, and we did 11 shots in six months. Now we’re doing more than 500 shots in three months. There’s a huge gap, and the technology accounts a lot for that. We are working on proprietary software, so we’re not using Nuke or Maya. We have an R&D department which releases software every three months for us. The tools are much more efficient now, especially for tracking and rotoscoping. This allows us more time to be creative with shots. When I manage a team, I only have generalists with me, and they’re working on all the shots, doing matchmoving, rotoscoping, modeling, texturing, lighting, compositing and rendering. Generalists are more personally involved in the process, which means they understand the sequence and story. They’re not only doing a task, but also their shots.”

Commercials are the core business for London-based Freefolk, which subsequently established a film and episodic depart-ment. “There are certain companies that specialize in one area or another, but we decided to have feet in both camps,” remarks Paul Wright, COO at Freefolk. “Commercials work in a far looser fashion, not necessarily requiring the dedicated tech pipeline that film or episodic requires. We developed a pipeline to go with film and episodic that has effectively been adopted company wide.” Diversification is critical. Wright notes, “You have to cast your net wider today than you might have needed to a long time ago. At the same time, you have to manage the delivery of all those and maintain the quality level that you would like to be able to deliver.” The visual effects industry has changed. “I remember when the industry was hardware-led and you couldn’t get your hands on the kit,” notes Meg Guidon, Executive Producer, Film & Episodic at Freefolk. “Things have broadened out tremendously, as well as what younger artists can offer. You need to be open to the talent that comes through your door, and we’ve got this expanding network of people we enjoy working with. If we see that they have a talent for motion graphics, our response isn’t, ‘We don’t really do motion graphics.’ We take it on and do it now.”

“When I manage a team, I only have generalists with me, and they’re working on all the shots, doing matchmoving, rotoscoping, modeling, texturing, lighting, compositing and rendering. Generalists are more personally involved in the process, which means they understand the sequence and story. They’re not only doing a task, but their shots.”

—Olivier Cauwet. VFX Supervisor, BUF

Headquartered in Culver City, California, Wylie Co. specializes in previs, postvis and visual effects for film and episodic. “Visual effects are so nuanced and complicated, but you’re still serving the subjective thing,” states Jake Maymudes, CEO & COO at Wylie Co. “You try to make it to order and hand it to the client. Then they can say, ‘It’s too blue or dark or light, change the animation.’ A lot of times, the company has to incur the costs of this very subjective thing they’re selling. It’s complicated and hard. In 2024, we lost money for the first time in 10 years, but this year we’re making money.” The actors’ strike had a substantial impact. Maymudes remarks, “It was a real hit to the industry. It’s still finding its feet. It was a big reset in the content. As far as visual effects is concerned, it could have been the combination of after the strike and Marvel at the same time realizing they made too [many films] because their slate has come way down.” AI and machine learning have become significant disrupters. “If you really dig in, the outcome could be, you film an entire feature film on an iPhone or something really small and run it through an AI post process to give it that epic Hollywood look and feel.” There is no desire to focus on one aspect of visual effects. Maymudes says, “I’ve never thought that special-izing was a good idea. which is why we do everything, even though we’re small. Even with the emergence of AI, my personal opinion is, specializing isn’t a good business model, because ultimately, you’re going to have competition that is going to do it just as good as you, and it’s going to be negligent. If you’re a working group of artists who are capable of doing great work in a variety of different ways, that’s what you should sell. Do it all. We use machine learning and AI in all sorts of ways. If you go in and specialize in machine learning face replacements or deepfakes, or even AI deepfakes, there could be a startup that you haven’t heard of yet that pops up next week and does that in a click of a button, essentially making your whole process obsolete.”

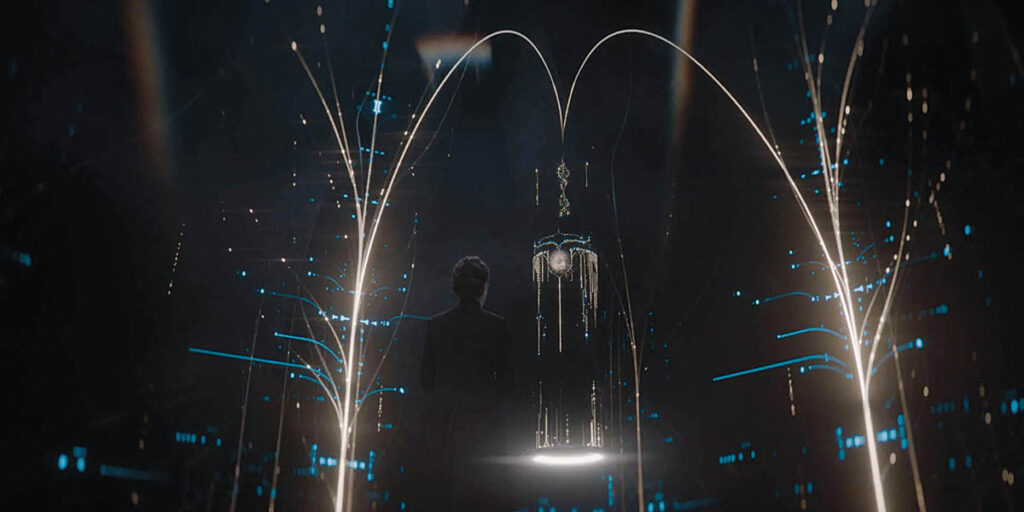

Straddling the world of visual effects and industrial design is the Territory Group, which originated in London. “We had that moment where everyone wasn’t looking for a new design studio, visual effects shop or digital agency,” recalls David Sheldon-Hicks, Founder of Territory Group. “We picked off niches in individual areas because we needed to find a way to thread between that, so it was the new things that were coming through. There were lots of freelancers working on on-set graphics. However, at the time, there were few small shops dedicated to on-set graphics that were doing it at scale with a robust structure behind them. Then, was anyone taking on-set graphics and applying it into post? There were post houses doing it, but I don’t know if they came from a design background.” Different industries cross-pollinate one another. Sheldon-Hicks says, “User interfaces and holograms in film feel connected to what’s happening in the automotive industry. Because we’ve been working in computer games, actually longer than films, games love to look at the film world and understand how they do what they do and then apply it in their own domain. Equally, the technology knowledge that we got from working in game engine for the last 15 years, not only has it been interesting in terms of virtual production, but also in terms of all the in-car experiences now built out in Unity or Unreal Engine; this is because they give you that next level of three-dimensional data and imagery that is real-time, that can be codified and powered through LiDAR scans or volumetric sensors. There’s this opportunity to use technologies from other fields and bring them across to other industries. We really enjoy that.”

Global creative studio Tendril, based in Toronto, uses design, animation and technology to produce innovative stories and branding. “Nothing that I’ve done in the past 20 years would I ever have anticipated or stepped toward intentionally,” notes Chris Bahry, Co-Founder and CCO of Tendril. “Either you run toward the work or the work runs toward you. On the side of our building, it says ‘Pure Signal,’ and we had a muralist do it typographically as a mural. It’s part of this phrase, ‘Put out a pure signal so the right people can find you.’ That’s our mantra: If you’re putting out the right signal in the form of the work you’re putting out, it’s going to attract the people you want to work with and probably the kinds of work you’re seeking to do.” The work falls on the boutique end of the spectrum. “Sometimes we have projects that are bigger and require a larger team, but they are tiny compared to the ones you have in a large visual effects facility. I’ve always thought of Tendril being akin to ILM’s Rebel [Mac] Unit led by John Knoll. They wanted an agile process based around artists who were general-ists and could take a shot from a concept, then design, develop, light and render it, and take it across the finish line. Whereas, in a scalable pipeline, normally it gets into a specialist workflow where it’s like an assembly line. Sometimes, certain problems are hard to solve in a linear, scaled-up specialist pipeline like that because it’s built to do particular things. The way Tendril is built is to be able to adapt and solve unique problems at a much faster cadence. Our project cycles tend to be about eight weeks, or we’ll sometimes only have two weeks to figure out something.”

Spanning Central Europe is PFX, a full-service post-produc-tion studio that started as a boutique studio in Prague. “In the beginning, we were an enthusiastic group of guys who wanted to be part of the industry and work on a nice movie,” recalls Lukas Keclik, Producer and Partner at PFX. “Little by little, through hard work, investing all of our money and using every contact, we experienced an evolution.” Subsidies are a driving force as to where the work gets sent, leading to additional PFX facilities being established in Slovakia, Poland, Germany, Austria and Italy. “A couple of years back, we realized that the company wasn’t small anymore, but not big enough. We started to feel this pressure of subsidies becoming more important. We had 150 people, so it wasn’t a boutique studio anymore, while the subsidies in the Czech Republic were not competitive enough. However, we didn’t want to be a big corporate studio. Based on our experiences and where we felt the industry was heading, the decision was made to be in multiple locations, ideally connected with one pipeline. We didn’t want to do a business model of having a headquarters and establishing satellite studios. We want to build a solid studio with a local presence and a supervisor in each branch with a production team. The first country was Slovakia, which offered a subsidy of 33%, and we built a studio from scratch. It took a year to establish a team and integrate them, which took too much time away from us having contact with our clients and team. Then we decided it would probably be better to go the acquisition route.”

Originating in Gothenburg and establishing an operation in Los Angeles, Haymaker VFX is an independent visual effects company that does films, episodic and commercials. “Everything in the industry is relationship-based and those relationships drive the type of work,” observes Leslie Sorrentino, Executive Producer at Haymaker VFX. “You’re seeing agencies pulling editorial and coloring in-house, but not heavy CG. Like animation, you’ve got a bandwidth of clients wanting more of this heavy lifting. Hence, the new Superman. We don’t want to see everything with the kitchen sink in it, but there are set extensions and period pieces. Also, we are the house of record for Polestar in Europe; that relationship gives me a lot of service stuff I can do, like putting cars in envi-ronments. On general visual effects marketing and what we’re doing, size does matter, and we have to grow exponentially. It is also compounded by the fact that you’ve seen the contraction of DNEG and closing of Technicolor. We started out doing Season 2 of Warrior Nun, working in conjunction with MCS Canada; that drove us more into the streaming services, which is where the business is at the moment.”

The streamers are going through a readjustment period in regard to demand for content. Sorrentino remarks, “The streaming services oversaturated the market in order to position themselves and, because of that, the content level became ridicu-lous. There is a cost we paid for that. I firmly believe that there will be winners and losers of the streaming environment. But there will still be fresh content with streamers developing things like Fallout, which was a gaming thing to begin with, or these other series that you’re seeing, like This Is Us. Those are going to continue to grow and be a force in our environment to provide work, but nowhere near the level where it expanded initially. It was much too over-blown. Hence the contraction now. That will still be a prominent source of revenue and work. Sports advertising will continue to grow, and experiential verticals are going to be an important part of visual effects growth integrated with AI.”

Embracing AI and machine learning is Toronto-based MARZ, which developed Vanity AI to process large volumes of high-end 2D aging, de-aging, cosmetic and prosthetic fixes, as well as LipDub AI, a realistic AI lip sync video generator. “It’s a niche-to-win strategy,” states Jonathan Bronfman, CEO at MARZ. “It’s still difficult, but going out there right now as any run-of-the-mill visual effects provider, you’re using the same tech and pool of artists; there’s no differentiation. It’s not a compelling pitch to a given project to say, ‘We’re MARZ and do great visual effects. We will give you a good price.’ Everyone is saying that. What I’m finding is that the produc-tions are finding more comfort going with the bigger shops. A lot of these shops are owned by studios: Pixomondo and Sony, Scanline VFX and Netflix, ILM and Disney. Those studios are incentivized to keep their own companies fed before feeding other companies. Historically, we were going after big shows like Marvel. The shows would typically go to ILM or Wētā FX, and ask, ‘How much can you take on?’ MARZ was a great alternative to deliver not the final sequence of an Avengers movie but a fight sequence within it. Now those big shops are taking all the work with no spillover.” Technology is the means to level the playing field. Bronfman states, “We’ve placed ourselves in the arena of AI and machine learning. Not only are we developing proprietary machine learning tools, but we’re also wrapping around some open-source projects. Some people resent that, because they think it’s taking away jobs. It’s not taking away jobs but opening up new jobs and opportunities that otherwise wouldn’t exist. But even more important is the differentiation. We have to, otherwise what’s our competitive edge?”

Originally centered around stop motion animation, Tippett Studio has gained a reputation for creating digital creatures. “Visual effects is an ever-evolving blend of technology and artistry,” notes Christina Wise, Vice President Business Development at Tippett Studio. “At Tippett, we stay at the forefront of innovation. We combine legacy techniques like stop-motion animation with cutting-edge tools, including AI, to push creative boundaries while meeting production demands. Expanding our clientele starts with the strength of our work and the legacy behind it. While relationships are key in this industry, we often hear from first-time clients drawn in by their admiration for Phil Tippett’s work and the reputation we’ve built over decades. People might not know the Tippett name right away, but chances are, they’ve grown up watching our work.”

Tippett Studio has become part of Phantom Media Group, which also includes PhantomFX, Spectre Post, Milk VFX and Lola Post. “As part of PMG, we think of ourselves as a new chain of interdependent studios, backed by the appeal of tax incentives and a global presence. Our outreach strategy combines inbound interest with traditional efforts: some clients find us, others we actively pursue. We’re especially seeing momentum from legacy and fan-driven projects, as well as a new wave of younger creators who are passionate about stop motion and anime aesthetics.” Diversification is paramount. Wise notes, “Tippett’s expansive footprint in China includes high-profile fly rides and immersive park content, which continue to perform strongly. Most recently, Jurassic World: The Exhibition opened in Bangkok, showcasing once again how audiences are eager for in-person, experiential storytelling. This type of project not only helps offset industry downswings but also aligns with the growing demand for physical, emotionally engaging experiences beyond the screen.